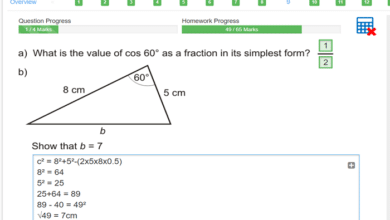

UPI India Payment Limits and Security Settings – What Every User Must Know

In 2025, upi印度 remains the most widely used digital payment system in the country, powering billions of transactions every month. While users enjoy the simplicity of instant transfers, QR-based payments, and frictionless merchant payments, many still do not fully understand the payment limits, security settings, restrictions, and risk-control measures built into UPI India.

This guide will help every user clearly understand:

- Daily, monthly, and per-transaction limits

- Bank-specific limits under UPI India

- Merchant transaction limits

- Restrictions on new accounts

- Cross-bank differences

- Security settings built into UPI India apps

- Fraud-protection features

- PIN rules, biometric rules, and device binding

- How to handle transaction failures and blocked payments

- How users can strengthen their own security

By the end, you will know exactly how UPI India limits work, why they exist, and how every security feature is designed to keep your money safe.

Introduction: Why Limits and Security Matter in UPI India

Most users assume UPI India works without restrictions—sending money anytime, paying merchants instantly, receiving payments instantly, and using QR codes without hassle. While this is mostly true, the UPI India ecosystem depends heavily on:

- Strict security rules

- Transaction caps

- Bank-level risk checks

- Real-time fraud detection

- User-level controls

- App-level authentication

These protections ensure that UPI India remains the safest real-time payment system in India and one of the fastest in the world.

Payment restrictions are not annoyances—they are essential safety tools. They prevent exploitation, help banks detect abnormal transfers, and protect users from unauthorized activity.

To understand this deeply, we must examine both the limit structure and security framework of UPI India.

Section 1: Standard UPI India Payment Limits (2025)

The National Payments Corporation of India (NPCI) sets core rules for UPI India transaction limits across all banks. These serve as default guidelines.

Below is the broad, detailed explanation of every limit users must know.

Per-Transaction Limit (Standard Personal Transfers)

For regular users sending money via:

- VPA

- QR Code

- Mobile number

- Account + IFSC

- Collect request

The maximum allowed is:

₹100,000 per transaction

(One lakh rupees)

This is the standard limit for most banks and applies across all UPI India applications.

This cap exists to:

- Protect users from large unauthorized transfers

- Reduce the impact of fraud

- Avoid system overload

- Encourage gradual risk monitoring at the bank level

Even if a user wants to send ₹5,00,000, they must break it into multiple ₹1,00,000 segments — provided their bank’s daily caps allow this.

Daily Limit for UPI India Transfers

Generally, users can transfer:

₹100,000 per day

(Total across all apps combined)

This means:

- If you send ₹50,000 via Google Pay

- And ₹50,000 via PhonePe

- You have reached your daily limit of ₹1,00,000

Daily limits reset at midnight.

Number of UPI Transactions Allowed Per Day

Many banks also cap daily transaction count:

- 10–20 transactions daily for some banks

- Unlimited for others

If you hit the transaction count limit, even a ₹1 transfer may fail.

This count limit protects against automated fraud or spam transactions.

Monthly Limits for UPI India

Though NPCI does not mandate a general monthly cap, many banks internally apply a rolling monthly limit:

- ₹1,00,00,000 (1 crore) for premium accounts

- ₹50,00,000 for regular accounts

- ₹10,00,000 – ₹20,00,000 for new accounts

These limits differ based on:

- Risk category

- Account vintage

- Banking behavior

- User profile

- Device risk score

This ensures stability and fraud prevention in the UPI India ecosystem.

Section 2: Merchant Payment Limits Under UPI India (P2M)

Merchant payments (P2M) — such as paying at shops, petrol pumps, cabs, hospitals, or online stores — follow different rules.

Standard Merchant Limit

Merchant transactions on UPI India allow higher per-transaction values than personal transfers.

₹200,000 per transaction

(2 lakh rupees)

This is double the standard P2P limit.

Daily Merchant Limit

The daily merchant limit is:

₹200,000 per day

This ensures businesses can receive large payments without restrictions.

Exceptions for High-Value Sectors

Some categories are permitted higher limits, such as:

- Education fees

- Medical payments

- Government services

- Loan repayments

Banks may allow up to ₹5 lakh or more for verified merchant categories, depending on NPCI guidelines.

Section 3: Bank-Specific UPI India Limits

Every bank can modify UPI India limits based on:

- Customer profile

- Account type

- Risk classification

- Regulatory instructions

- Fraud patterns

- Transaction volumes

Below are broad examples of variations seen across banks.

- Example: State Bank of India (SBI)

- Per transaction: ₹1 lakh

- Daily limit: ₹1 lakh

- Merchant limit: ₹2 lakh

- HDFC Bank

- Per transaction: ₹1 lakh

- Daily limit: ₹1 lakh

- App transaction count limit: 10–20

- ICICI Bank

- Per transaction: ₹1 lakh

- Higher limits for premium accounts

- Additional checks for new accounts

- Axis Bank

- Similar core limits

- Strong fraud detection layer

- Paytm Payments Bank

- UPI limit: ₹1 lakh

- Transaction count limits vary

- India Post Payments Bank

- May impose more conservative limits for rural protection

These examples show that while NPCI sets basic limits, the final limit applied depends on the user’s bank.

Section 4: Limits for New Users on UPI India

New UPI India users often complain:

“Why can’t I send more than ₹5,000?”

“Why is my limit only ₹25,000?”

“Why are my payments failing?”

This is because banks apply stricter limits for:

- New customers

- New UPI registrations

- Recently activated debit cards

- Recently opened accounts

- First-time UPI PIN setups

Typical new-user limits include:

- ₹5,000 to ₹25,000 for the first 24 hours

- ₹25,000 to ₹50,000 for the first week

- Full limits after 7–30 days

This prevents fraudsters from opening accounts and immediately initiating high-value transactions.

Section 5: Security Settings in UPI India

Security is the backbone of UPI India. Below are the complete security layers in great detail.

UPI PIN Protection

Every transaction requires a 6-digit UPI PIN.

Why PIN matters?

- Prevents unauthorized transfers

- Verifies the actual account holder

- Acts as a digital signature

Users must:

- Never share PIN

- Avoid common patterns (000000, 123456)

- Change PIN every 3–6 months

- Use separate PINs for different accounts

Device Binding

A powerful security feature of UPI India is device binding.

Device binding means:

Your UPI account is tied to:

- Your phone’s SIM

- Your phone’s device ID

- Your UPI app installation

If anyone installs your UPI app on another device, they cannot use your UPI India account.

Mobile Number Verification

UPI India requires the phone number to be:

- Active

- Linked with bank account

- On the inserted SIM card

This prevents misuse of virtual accounts.

Bank-Level Encryption

All UPI India transactions are encrypted end-to-end:

- User → App

- App → Bank

- Bank → NPCI

- NPCI → Receiving Bank

This ensures complete privacy and integrity.

Biometric Security (Optional But Recommended)

Most UPI apps support:

- Fingerprint unlock

- Face unlock

This prevents unauthorized access even when someone holds your phone.

App Lock Settings

Users can apply:

- App-level PIN

- Pattern lock

- Auto-lock timers

- Device security policies

This adds an extra protection layer to UPI India apps.

Fraud Detection System

NPCI and banks monitor:

- Suspicious logins

- Unusual payment patterns

- Velocity checks

- Multiple failed attempts

- New device login

- High-value request patterns

If something looks wrong, transactions may be blocked automatically.

Blocking and Reporting Fraud in UPI India

If users detect fraud:

- Contact bank customer care

- Disable UPI temporarily

- Block debit card

- File a cyber complaint

- Provide UTR numbers

- Change UPI PIN immediately

UPI India fraud support works 24/7.

Section 6: Payment Failures and UPI India Restrictions

Even though UPI India is fast, some payments fail due to:

- Bank server downtime

Most common cause.

- Exceeding limits

Daily or per-transaction caps.

- Wrong PIN

Multiple incorrect attempts lock UPI temporarily.

- Suspicious activity detection

System blocks unusual transactions.

- Connectivity issues

Poor network delays the process.

- New account restrictions

Banks protect new users with lower caps.

Section 7: How to Increase UPI India Limits

Users can try:

- Upgrading to premium accounts

- Requesting limit increase via bank

- Improving transaction history

- Maintaining consistent KYC

- Using the same device regularly

- Avoiding suspicious activity

Banks may increase limits after evaluating risk.

Section 8: Best Practices to Stay Safe on UPI India

To maximize safety, users should:

- Never share UPI PIN

No bank employee will ever ask for it.

- Avoid scanning unknown QR codes

QR codes can be manipulated.

- Use only official UPI apps

Avoid clones on Play Store.

- Keep phone updated

Security patches matter.

- Enable biometric lock

Adds instant protection.

- Monitor transaction history

Spot unusual payments.

- Avoid public Wi-Fi

Risk of interception.

- Disable UPI during phone loss

Notify your bank immediately.

Section 9: The Future of Limits and Security in UPI India

Upcoming changes include:

- UPI India international payments

- Smart dynamic limits

- AI-based fraud prediction

- Offline UPI India

- UPI Tap & Pay

- Digital Rupee integration

These will make UPI even more secure and faster.

Conclusion

upi印度 payment limits and security settings exist to protect users, ensure safe transactions, and maintain system integrity. With daily limits, per-transaction caps, strict PIN requirements, biometric locks, device binding, and bank-level encryption, UPI India gives users both speed and safety. As UPI continues to evolve, these protections will only strengthen, allowing India’s digital economy to grow with confidence and trust.